Heading out the door? Read this article on the new Outside+ app available now on iOS devices for members! Download the app.

With the 2024 rosters finally set and the racing action coming thick and fast this weekend with the AlUla Tour, Etoile de Bessèges, Volta Valenciana, and CX World Championships, I am finally wrapping up the off-season content by releasing my annual BTP NET Ratings.

What Are the BTP NET Ratings?

Unlike most professional sports, there is no real advanced analytics to rate individual performers or teams as a whole, which makes objective big-picture analysis incredibly difficult. So, since an obsession of mine is attempting to figure out the most effective way to build a pro cycling team, I’ve created my own team in-house rating system, called the BTP NET Rating, that should let us project how much teams have gotten better or worse over the transfer window.

I created the NET rating via the simple process of taking each team’s total Pro Cycling Stats points total from the 2023 season and adding/subtracting the number of aggregate PCS points they gained/lost in the transfer market, which illustrates how the teams would rank if every rider currently on the roster was on the team in the year prior.

This exercise has done a surprisingly good job of predicting performance for teams in the upcoming season despite two major blind spots:

- Since riders don’t perform exactly the same every season and are subject to progression and regression based on age, experience, and opportunities, this system is obviously far from perfect.

- Also, this exercise doesn’t consider that roughly half of a pro team might not even be attempting to get results, which, in turn, will generate points. But, with teams increasingly taking riders who are able, or have in the past, scored personal results and turning them into domestiques, we can still get a decent overview of a team’s overall strength.

Overall, the NET Rating gives us a nice baseline from which to operate and a pretty clear picture of each team’s current personnel strengths and weaknesses. I also think it helps show an objective rating of each team’s off-season, which is important since there can sometimes appear to be a fundamental misunderstanding among pro cycling team managers on what makes a successful pro cycling team. This means that management teams with more numbers-based approaches can capitalize on the inefficiencies created by the number-blindness prevalent in the sport that tend to lean on high-powered agents to funnel star, or up-and-coming, riders into their programs, which means they end up paying riders for past results and fail to set themselves up for future success.

- So, in the end, simply compiling PCS data for your roster and following the simple logic that riders who have performed well in the past tend to perform well in the future while young riders tend to get better and older riders tend to get worse can take a manager a long way towards building a successful pro cycling team.

Also read: Low Quantity but High Quality: American WorldTour Riders Are Doing More with Less

2024 Team BTP NET Projections

Tier 1

1) UAE-Team EmiratesTeam: 11,004

2) Visma – Lease a Bike: 9,882

Tier 2

3) BORA – Hansgrohe: 8,399

4) Lidl – Trek: 8,051

5) Team Jayco AlUla Team: 6,299

6) Alpecin – Deceuninck: 6,278

7) INEOS Grenadiers: 5,944

Tier 3

8) Soudal – Quick Step: 5,655

9) EF Education – EasyPost: 5,496

10) Lotto Dstny: 5,453

11) Decathlon AG2R La Mondiale: 5,345

12) Bahrain – Victorious: 5,318

Tier 4

13) Movistar Team: 4,981

14) Astana Qazaqstan Team: 4,934

15) Israel – Premier Tech: 4,892

Tier 5

16) Cofidis: 4,337

17) Groupama – FDJ: 4,192

18) Uno-X Mobility: 4,175

19) Arkéa – B&B Hotels: 3,912

Tier 6

20) Team DSM-Firmenich PostNL: 3,772

21) Tudor Pro Cycling: 3,769

22) Intermarché – Wanty: 3,440

Tier 7

23) Q36.5 Pro Cycling Team: 3,074

24) TotalEnergies: 2,732

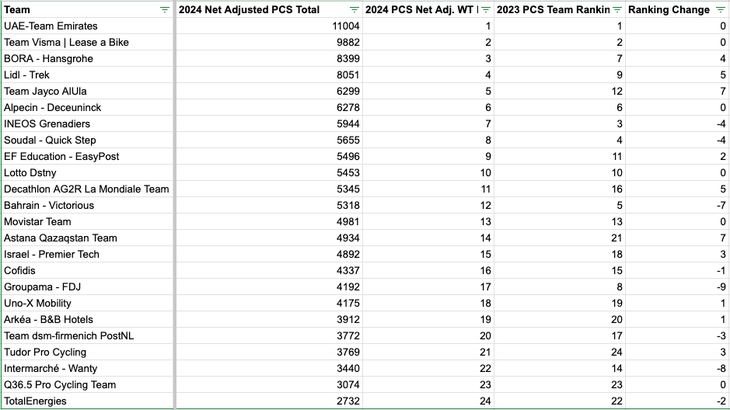

Below is a spreadsheet showing how each team’s BTP NET 2024 rankings compare to where they finished in the PCS rankings at the end of 2023.

2024 NET PCS Totals & Off-Season Ranking Change

And, if we dive in a bit further and examine each team’s gained/lost PCS points over the off-season, we can isolate and rank the quality of each team’s transfer strategy.

PCS Points Gained/Lost Per Team During Off-Season

BORA – Hansgrohe +2083

Lidl – Trek +1967

Tudor Pro Cycling +1885

Astana Qazaqstan Team +1745

Team Jayco AlUla +1225

Q36.5 Pro Cycling Team +951

Decathlon AG2R La Mondiale Team +720

Uno-X Mobility +480

Israel – Premier Tech +406

Arkéa – B&B Hotels +264

EF Education – EasyPost +214

Alpecin – Deceuninck -62

Movistar Team -81

UAE-Team Emirates -86

TotalEnergies -315

Cofidis -426

Lotto Dstny -567

Team DSM-Firmenich PostNL -736

Team Visma | Lease a Bike -934

Intermarché – Wanty -1403

Bahrain – Victorious -1896

Groupama – FDJ -1992

Soudal – Quick Step -2033

INEOS Grenadiers -2148

- This simple exercise gives us much more clarity than we would expect. For example, we can see that while the sport’s two dominant teams, Visma-Lease a Bike and UAE, are still head and shoulders above the rest of the sport, they haven’t added to their roster strength as much as in years past (partly out of not having much more room to grow).

- Meanwhile, it is clear that Bora-Hansgrohe, Jayco-Alula, Lild-Trek, Tudor, and Astana have ‘won’ the off-season and climbed the ranks heading into 2024. In contrast, Groupama-FDJ, which had a strong 2023 season, has seen the steepest roster quality dropoff over the off-season, while Ineos, who was formerly the sport’s top team, continues to tumble down the roster strength rankings.

Key Takeaways:

1) Visma & UAE appear to have finally hit ‘Peak Talent,’ but their dominance is likely far from over

- Following the 2022/23 off-season, where they each added over 1,000 net PCS points, the sport’s two Super Teams, Visma – Lease-a-bike and Team UAE, have finally hit a talent plateau, with both teams suffering PCS points deficits over the most recent off-season.

- However, in this case, the top-line numbers don’t tell the entire story, especially since, due to enjoying so much recruiting success over the past few years, both teams don’t realistically have room remaining to grow, at least in a strictly points-related sense.

- Additionally, both teams executed fairly intense roster remodels, parting with long-time veterans while re-stocking with less accomplished but highly capable young riders who they hope will slot into key support roles for their supernova-level stars.

- Visma’s points deficit is exclusively due to losing veteran and points machine Primož Roglič, but it brings in a fleet of extremely talented riders, Matteo Jorgenson and Cian Uijtdebroeks.

- UAE’s off-season was marked by their efforts of finally sending out high-profile riders that didn’t serve their agenda of challenging Visma and Jonas Vingegaard in Grand Tours, while bringing in riders like Pavel Sivakov and Nils Politt, who may not score immense amounts of points, but can be slotted into valuable roles in their Grand Tour teams.

- Both teams have also aggressively recruited young talent (like Isaac del Toro) that they hope will blossom into future stars, but due to being neo-pros, don’t come with significant amounts of PCS points.

2) The upwardly mobile are featured at the top of the transfer ‘winners’ list

- Looking at the top of the numerical leaderboard, a few teams that have undergone dramatic roster rebuilds, either brick-by-brick like Astana, or with one big swing like Bora, enter the 2024 season with increased expectations:

- BORA – Hansgrohe: +2,083 PCS points & +4 ranking spots

- Lidl – Trek: +1,967 PCS points & +5 ranking spots

- Tudor Pro Cycling: +1,885 PCS points & +3 ranking spots

- Astana Qazaqstan Team: 1,745 PCS points & +7 ranking spots

- Team Jayco AlUla: 1,225 PCS points & +7 ranking spots

- Of course, due to starting from vastly different spots, not all of these improvements are created equal.

- While Bora is now creeping into Tier 1 due to their blockbuster signing of Roglič, Tudor is just beginning to climb out of the basement and aiming to assemble a roster to compete for stage wins in the Grand Tours.

- The most interesting teams in this ‘winners’ category are Bora, Lidl, and Jayco.

- Bora went from having a nice team to potentially being able to challenge for the Tour de France title with one signing due to the pickup of Roglič.

- Lidl builds off an impressive 2023 by bringing on riders like Tao Geoghegan Hart and Jonathan Milan, who could take them out of the mid-table and into the top tier.

- After a few seasons in which they appeared lost in the wilderness, Jayco could be back to their plucky over-performer days due to the addition of young talent (and homegrown should-be star Luke Plapp).

- The most interesting teams in this ‘winners’ category are Bora, Lidl, and Jayco.

- While Bora is now creeping into Tier 1 due to their blockbuster signing of Roglič, Tudor is just beginning to climb out of the basement and aiming to assemble a roster to compete for stage wins in the Grand Tours.

3) The ‘losers’ lists highlight just how far, and quickly, a formerly dominant team can fall

- The bottom of the projected table stands out because it is stacked with brand-name teams that all finished inside the top 9 as recently as the 2022 PCS points team rankings.

- INEOS Grenadiers: -2161 PCS points & -4 ranking spots

- Groupama – FDJ: -2148 PCS points & -9 ranking spots

- Bahrain – Victorious: -1902 PCS points & -7 ranking spots

- Soudal – Quick Step: -1567 PCS points & -4 ranking spots

- Intermarché – Wanty: -1198 PCS points & -8 ranking spots

- This is partly because these teams had room to fall, but it also effectively highlights the hard times that have befallen each team over the last few off-seasons.

- For example, Ineos, which has led the WorldTour in PCS points net outflows for two straight off-seasons, is clearly struggling due to uncertainty with its front office management, which has seen them lose multiple top riders, while failing to retain new ones, while the team’s (now former) GM Dave Brailsford has been preoccupied with intense football (soccer) rebuilds at OGC Nice, and now, Manchester United.

- Also, Groupama-FDJ, in response to the departures of two of their most productive riders via the long-telegraphed retirement of Thibaut Pinot, and the outgoing transfer of Arnaud Démare, re-stocked with high-upside youth, which has seen them dramatically tumble down the projected finish standings.

- The transfer performances of Intermarché and Soudal-QuickStep are mainly related to their inability to match the high salaries offered by the sport’s best teams in recent years.

- However, both teams have responded to these financial issues by building relatively inexpensive, but strong, teams around their respective stars, Biniam Girmay, and Remco Evenepoel, and, as a result, have become incredibly heliocentric organizations.

4) Teams can significantly over-and-under-perform these rankings on a short-term basis, but, over the long run, a positive net transfer score is important to team success

- Almost as though they are attempting to prove the fragility of this model, many of the teams with poor off-season performances have come out of the gate firing in 2024, with Israel-Premier Tech, Intermarché, Ineos, and Groupama all sitting in the top five of the PCS points rankings, while Visma sits a lowly 20th.

- However, instead of crowning Israel-Premier Tech as a new Super Team and writing Visma off as a failure, we should note that these teams have come out strong precisely due to the fact that they have recognized they need to target these early races to get a head start on the teams with stronger rosters.

- However, these initial overperformances underline an important point: While these rankings are a helpful tool, it is important to note that teams can significantly outperform their BTP rankings season by season.

- For example, in 2023, Lotto-Dtsy, Lidl-Trek, and Jayco-Alula all finished much higher in the final standings than their pre-season projections would have suggested. This is mainly due to the highly productive young riders on their roster who could net more points than they had in years past.

- However, this overperformance isn’t sustainable over the long term (see: Intermarché in 2022 & 2023) since these talented young riders are baked into the team’s projection for the following season, which means the team will need to continue to add another batch of unknown young talents to continue to out-perform their ranking.

- This makes it notable that two overperformers, Lidl and Jayco, upgraded their rosters with proven entities in 2024 to build off their 2023 overperformance.

- However, this overperformance isn’t sustainable over the long term (see: Intermarché in 2022 & 2023) since these talented young riders are baked into the team’s projection for the following season, which means the team will need to continue to add another batch of unknown young talents to continue to out-perform their ranking.

- For example, in 2023, Lotto-Dtsy, Lidl-Trek, and Jayco-Alula all finished much higher in the final standings than their pre-season projections would have suggested. This is mainly due to the highly productive young riders on their roster who could net more points than they had in years past.